closed end loan vs credit card

When you pay off a loan the account is considered closed and if you want to borrow more money youll have to apply for another loan. Allows for higher borrowing limits suited to consolidate large amounts of credit card debt.

Sofi Credit Card Vs Venmo Credit Card Nextadvisor With Time

The funds investment objective is to seek a high level of current income.

. Your next account statement closing date would be May 1. Assuming your credit card account was in good standing when you paid off the balance the account will remain open. The Allspring Global Dividend Opportunity Fund is a closed-end equity and high-yield bond fund.

Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. This offer cannot be combined with the SoFi Checking and Savings Direct Deposit rate discount on a SoFi personal loan. Some lenders will pay your creditors directly so.

Keep Your Credit Card Account Active. Advantages of a debt consolidation loan. Example shown is for a fixed rate 20-year closed-end home equity loan.

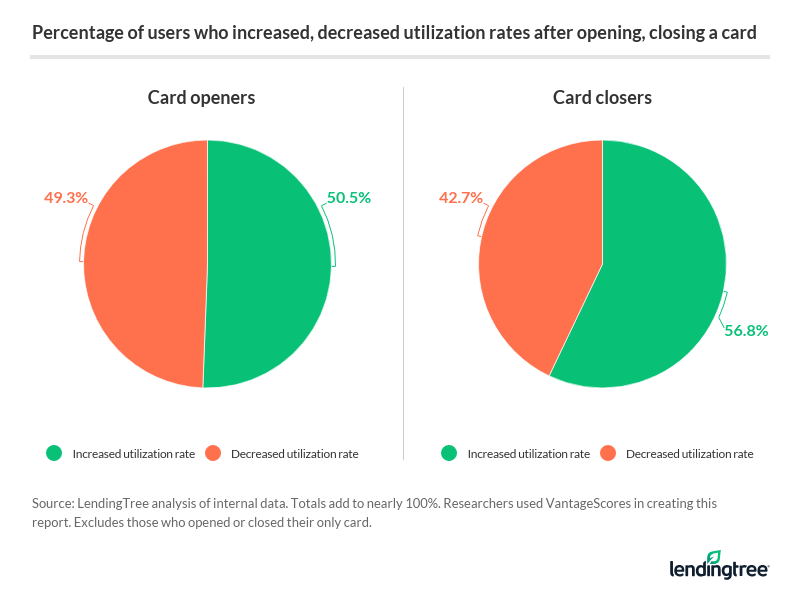

Bonuses are considered miscellaneous income and may be reportable to the IRS on Form 1099-MISC or Form 1042-S if applicable. Guide to refinancing. Balances held on all accounts added up and compared to the summed maximum credit of the same group of accounts is known as a credit utilization ratio.

In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds. For example say your previous credit card statement had an account closing date of April 2 and there are 29 days in your billing cycle. Canceling a credit card might seem like a simple way to move on to a new better option or maybe you want to end a relationship with a card that you now realize was too costly and partly to blame for your debt problems.

When a credit card account is closed the. You can use a debt consolidation loan to consolidate multiple types of debt like credit card debt medical bills and other personal loans. Reverse Mortgage Line of Credit.

All specific interest rates and APRs as well as other terms and conditions are disclosed during the application process. These closed-end funds offer high yield in a low-dividend environment. Select a credit card debt reduction strategy.

Auto Loan Refinance Rates. All the transactions between April 3 and May 1 will be included on your next credit card billing statement. SoFi will credit members who meet qualification criteria within 14 days of the end of the Evaluation Period.

Typically will offer lower interest rates than similar credit card options. The credit line option. Advertised interest rates and APRs are considered base rates.

The funds secondary. Listing these credit card details will let you easily progress to the next step in paying off your credit card debt. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months.

Consolidates multiple credit card debts into a single loan payment making it easy to manage and build a budget around. Using the snowball method to pay off credit card. Actual payment will vary based on final loan terms and may be higher.

Approved or endorsed by any other entities such as banks credit card. Paying off a credit card isnt like paying off a loan. Auto Loan Rates.

According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them. While your loan is processing dont open new credit accounts or make other large purchases until the new mortgage closes. But a closed credit card can stick out like a sore thumb on your credit reports and affect your scores considerably.

The APR will vary with Prime Rate the index as published in the Wall Street Journal. Doing so can derail your application. Now that you know your budget and the details of your credit card debt you can select a strategy to pay off your credit card debt.

5 Things To Know About The Chime Credit Builder Visa Secured Credit Card Forbes Advisor

Mission Lane Visa Credit Card Reviews 2022 Credit Karma

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

Credit Card What It Is How It Works And How To Get One

Usda Loan Pros And Cons Usda Loan Understanding Mortgages Mortgage

Credit Cards Types Of Debt How Credit Cards Work

Advantages Of A Credit Card Discover

Advantages Of A Credit Card Discover

How Much Credit Should I Have And Does It Impact My Credit Score Forbes Advisor

Advantages Of A Credit Card Discover

10 Good Reasons To Use Your Credit Card

Credit Card Processing Fees 2022 Guide Forbes Advisor

Do Magnets Affect Credit Cards Bankrate

Credit Card Debt Is Rising But Still Lower Than Before Covid Marketplace

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

What Are Open Ended Lines Of Credit Line Of Credit Open Ended The Borrowers

Credit Score Movements When Opening Closing A Card Lendingtree

How To Pick The Best Credit Card For You 4 Easy Steps Nerdwallet

Consumer Loan Application Credit Union Form Http Www Oaktreebiz Com Products Services Consumer Lendi Credit Card Application Consumer Lending Personal Loans

Knowing How To Calculate Cibil Score On Credit Card Is Very Important If You Want To Stay Away Fr Credit Card Help Credit Card Consolidation Credit Cards Debt